The performance of Canada’s Economy in Q2 came as a surprise with GDP falling by 0.2% (annualized) when it was expected to grow by 1%. Most of this decline happened in June. Now, as we move into Q3, early estimates for July show that GDP remained “essentially unchanged.”

Here’s a simplified breakdown of the key points:

- Q2 Contraction: Canada’s economy didn’t perform as expected in Q2. Instead of growing, it contracted by 0.2%. June saw a significant 0.2% drop in GDP, contributing to this decline.

- July’s Stagnation: The early estimate for July suggests that GDP didn’t change much compared to the previous month. Other data releases support this estimate.

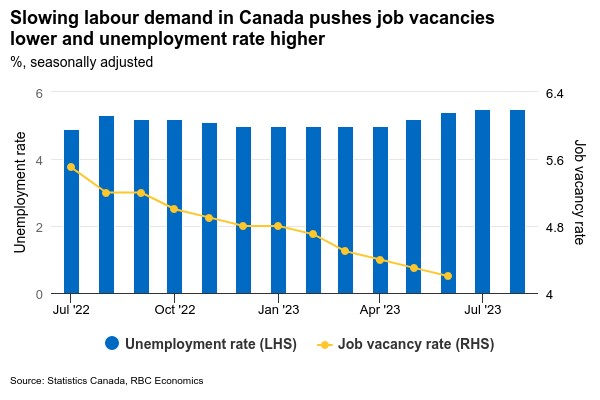

- Employment Situation: In July, employment decreased by 6,000 positions, and the unemployment rate increased, reflecting a slowdown in labor demand.

- Manufacturing and Wholesale: Manufacturing sales rose slightly in July, but this increase came from existing inventories rather than new production. Wholesale sales volumes remained mostly unchanged, except for a surge in petroleum sales.

- Retail Sales Soften: Retail sales continued to decline, with volumes falling by 0.2% after a substantial 3.3% drop in Q2.

- Factors Behind Weakness: Some of the weakness in Q2 can be attributed to temporary factors, like a federal government workers’ strike in April and disruptions to the mining sector due to wildfires. However, this softening trend appears to have continued into Q3.

- Outlook for Q3: If July’s GDP remains flat, it will be around 0.4% (annualized) below the Q2 average. This aligns with forecasts of a 0.5% decline in Q3 output.

- Unemployment Rate: The unemployment rate, which is less affected by transitory disruptions, has increased by half a percentage point over the last four months.

- Spending Patterns: Rising interest rates are affecting households’ buying power, leading to reduced spending on discretionary items like motor vehicles, hotels, and restaurants.

- Inflation Outlook: Despite an upside surprise in August, elevated interest rates are expected to decrease inflation pressures.

In the coming week, keep an eye on U.S. personal consumption expenditure, job vacancy, and employment growth numbers in Canada, as well as Q2 population estimates, and potential impacts on Canadian auto production due to U.S. strikes. These factors will continue to shape Canada’s economic landscape in the months ahead.

Please contact Jared Gibbons, your local realtor, should you have any questions!