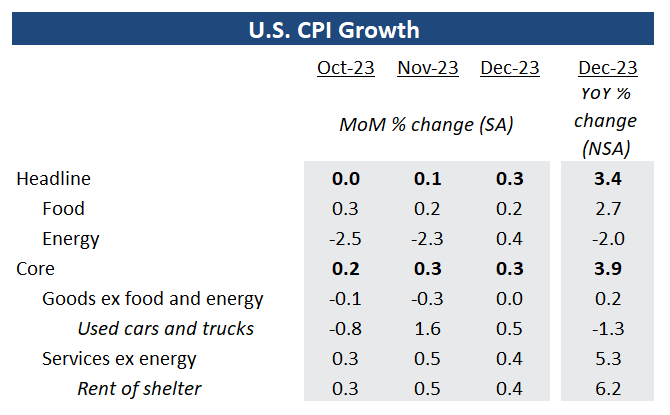

December’s U.S. inflation figures brought a modest surprise, with the headline inflation rate rising to 3.4%, slightly above expectations. In this blog post, we’ll break down the key components of this report, focusing on what drove the increase and what it means for the broader economic outlook.

1. Energy Inflation Takes the Lead:

- The December uptick was largely fueled by rising energy inflation, pushing the headline rate to 3.4% from November’s 3.1%.

- Gasoline prices remained stable on a seasonally adjusted basis, with year-over-year prices showing a smaller decline compared to the previous month (-1.9% in December).

2. Food Prices Show Mixed Signals:

- Food inflation in the U.S. slowed to 2.7% year-over-year in December, marked by a small 0.2% month-over-month change.

- Grocery inflation eased to 1.3%, while dining-out prices maintained a growth rate of 5.2%.

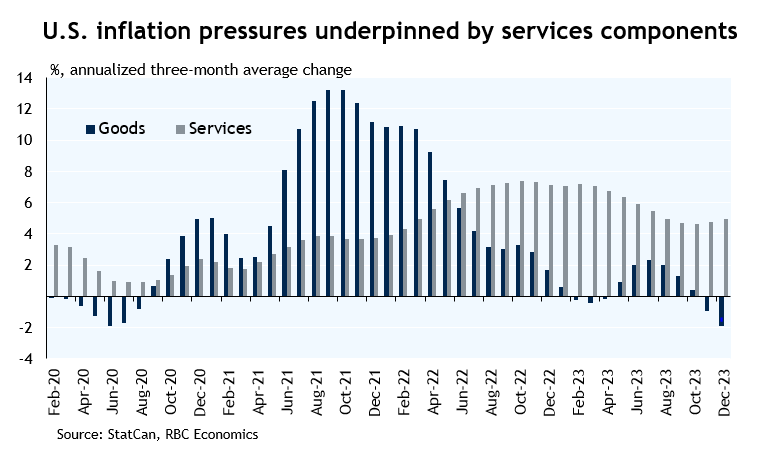

3. Core Prices and Services Components:

- Core price growth, excluding food and energy, slowed to 3.9% from 4% in November.

- Services components, particularly shelter services, attributed to 70% of the 0.3% monthly growth in December.

4. Supercore Measure and Future Outlook:

- The Fed’s ‘supercore’ measure, excluding rent, rose by 0.4% in December, influenced by higher medical care costs.

- Despite the surprise in inflation readings, underlying details suggest ongoing trends of easing inflation pressures.

5. Federal Reserve’s Response:

- The Federal Reserve signaled potential interest rate cuts in December, acknowledging the evolving economic landscape.

- Despite inflation surprises, the central bank remains cautious, considering a resilient labor market and a solid consumer backdrop.

Conclusion:

While U.S. inflation showed a marginal upside surprise in December, the underlying details suggest that the broader narrative of easing inflation pressures remains intact. The Federal Reserve, taking the first step toward potential rate cuts, maintains a cautious stance in response to the economic landscape. Looking ahead, the expectation is for the first cut in the fed funds target range in Q2, reflecting a balanced approach to economic stability.

Please contact Jared Gibbons, your local realtor, should you have any questions!