As summer heats up in Canada, so does anticipation for the July Consumer Price Index (CPI) report. The Bank of Canada closely watches this data to make decisions on future rate hikes. In this blog post, we break down the main points of the upcoming report, exploring what drives inflation, how it might affect monetary policy, and the overall economic picture.

-

Inching Upward: Exploring Inflation Dynamics

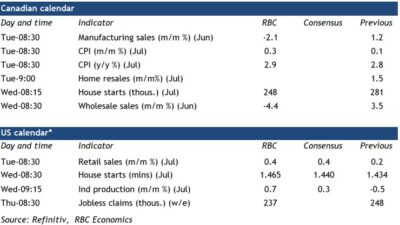

- In June, the CPI had a 2.8% year-over-year inflation rate, slightly below the Bank of Canada’s target. Eyes are now on the expected rise to 2.9% in July.

- Energy prices, especially gas, are contributing to this increase, with oil prices crossing $80 per barrel in August.

-

Beyond Energy: A Holistic View of Inflation Pressures

- The Bank of Canada looks beyond energy and is concerned with a broader perspective.

- Food prices are expected to remain high in July but show signs of slowing due to lower commodity prices and improving supply chains.

- Excluding food and energy, the rate of price growth is projected to decrease to 3% year-over-year.

-

Economic Context: Navigating Uncertainties

- Inflation’s trajectory depends on the strength of the Canadian economy.

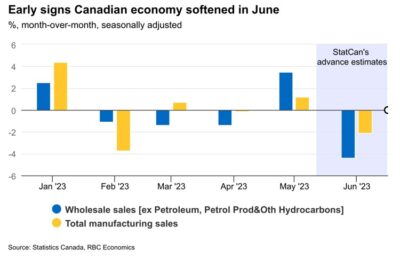

- Consumer spending has been resilient, but recent indicators suggest some softening.

- Economic vulnerabilities may emerge, impacting underlying price pressures.

-

Week Ahead: A Data Watch

- Key economic indicators ahead, offering insights into the health of the Canadian economy:

- A 4.4% drop in “core” wholesale sales in June.

- Monitoring the cooling trend in the housing market with July home resales data.

- A 2.1% decline in advance manufacturing sales for June.

- Predicted decline in housing starts from June to July.

- Anticipated uptick in U.S. industrial production for July.

- Key economic indicators ahead, offering insights into the health of the Canadian economy:

As the July CPI report approaches, it’s a crucial moment to understand inflation dynamics in Canada. While energy prices play a role, the Bank of Canada considers factors beyond them. The resilience of consumer spending and the evolving economic backdrop paint a vivid picture of Canada’s economic health. With potential vulnerabilities emerging, it remains to be seen how underlying price pressures will evolve. Insights from the CPI report will guide future monetary policy and economic strategies.

Please contact Jared Gibbons, your local realtor, should you have any questions!