The Bank of Canada has recently cut the interest rate to 4.5%, marking a key change in the interest rate cut impact on the economy and homebuyers. This reduction is, notably, the second since March 2022. Consequently, it offers new opportunities for homebuyers. Here’s what you need to know about this Bank of Canada interest rate cut and how it affects your mortgage payments.

Current Rates

- Overnight rate: 4.5%

- Prime rate: 6.70%

- Trend: This is the second rate decrease observed since March 2022.

Factors Influencing the Decision

- Inflation: Primarily, the decision is driven by softening inflationary data. Furthermore, increased unemployment rates contribute to the decision.

- Unemployment: The unemployment rates have increased to 6.4%. As a result, this rise reflects the impact of the interest rate cut on the job market.

Impact on Mortgages

- Pre-Approved Mortgages: If you have a pre-approved mortgage, you should contact your mortgage adviser. This will help you understand how the interest rate cut affects your qualifying amount.

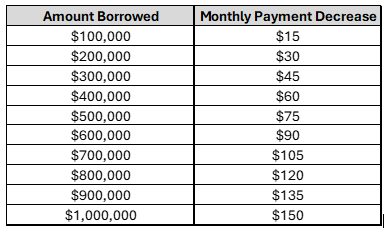

- Variable Rate Mortgage Holders: On the other hand, this rate cut benefits those with variable rate mortgages. Specifically, for every $100,000 borrowed, the payment decreases by approximately $15, highlighting the impact of the Bank of Canada interest rate cut.

Breakdown of Monthly Payment Decrease

Here’s a detailed breakdown of the expected monthly payment decrease for various loan amounts:

As a result, this reduction in monthly payments provides significant savings. Consequently, it makes homeownership more affordable. Therefore, consider consulting with your mortgage adviser to benefit from these lower rates.

Economic Benefits

The interest rate cut is expected to stimulate the local economy. Specifically, lower rates encourage borrowing and investing. This, in turn, leads to increased consumer spending. Thus, it stimulates various sectors, from housing to retail, fostering growth and job creation.

Key Points for Readers

- Affordable Mortgages: As a result of the interest rate cut, mortgages are now more affordable. This creates an opportune moment for buyers.

- Economic Stimulus: Furthermore, the rate reduction boosts consumer spending and business investments, driving local growth.

- Long-Term Benefits: Increased homeownership and business expansion, in turn, lead to sustained economic benefits, including job creation.

Looking Ahead

Looking ahead, the next rate announcement from the Bank of Canada is scheduled for September 4th, 2024. Stay tuned for updates and keep an eye on this important date.

The Bank of Canada’s decision to lower interest rates aims to bolster the economy and support homebuyers. For those looking to buy a new home or considering investment opportunities, now is a particularly advantageous time to act. Thus, this policy shift plays a crucial role in revitalizing the local economy and enhancing financial stability.