Canada’s economic performance in the second quarter of the year brought some surprises and challenges. In this blog post, we’ll break down the key points from the recent GDP report and what they mean for the Canadian economy.

GDP Falls Short of Expectations

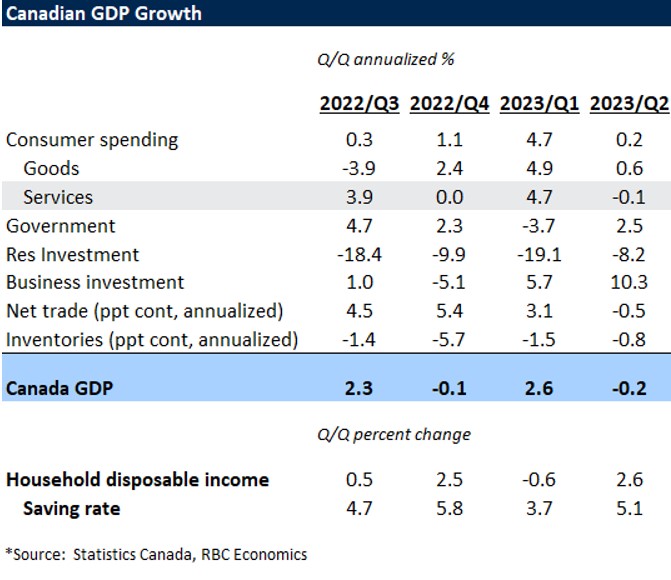

Canadian GDP in Q2 took a slight dip, with a decrease of 0.2% at an annualized rate. This outcome was unexpected; as initial estimates had predicted a 1% increase. The disappointment stems from several factors affecting economic activity.

Monthly Weakness in June

One of the contributing factors to the overall decline was a 0.2% drop in output during the month of June. July’s GDP estimate remained “essentially unchanged” from June, resulting in a challenging start to Q3, with activity down approximately 0.4% in this quarter.

Consumer Spending and Residential Investment

While consumer spending increased by 0.2% in Q2, it marked the smallest rise since the pandemic-induced lockdowns in Q2 2021. Residential investment continued to decline, despite a rebound in the home resale market, as new building activity decreased.

Business Investment and Trade

On a positive note, business investment saw growth, partially driven by a surge in imported aircraft purchases. However, net trade had a negative impact on GDP growth, with imports increasing at a faster rate than exports.

Economic Headwinds

The Q2 GDP decline was partially expected due to factors such as the federal workers’ strike in April. However, other indicators, including labor market data, have been showing signs of softening. The unemployment rate has risen by half a percent over the last three months, and consumer delinquency rates have been creeping up.

Impact on Bank of Canada (BoC) Policy

The GDP data is likely to influence the Bank of Canada’s (BoC) monetary policy decisions. It is increasingly expected that the BoC will halt further interest rate hikes in the near term. While the BoC doesn’t base its decisions solely on one data point, the economic landscape is changing.

Looking Ahead

Although inflation remains above target rates, the impact of previous interest rate hikes is starting to cool GDP growth and labor markets. Policymakers are likely to keep the option of future rate hikes open, but if the unemployment rate continues to rise, as predicted, the need for further hikes may be unnecessary.

In conclusion, the Q2 GDP report for Canada reveals a mixed economic picture, with challenges and uncertainties. Policymakers will closely monitor these developments to ensure that the Canadian economy remains on a stable path in the face of evolving conditions.

Please contact Jared Gibbons, your local realtor, should you have any further questions!