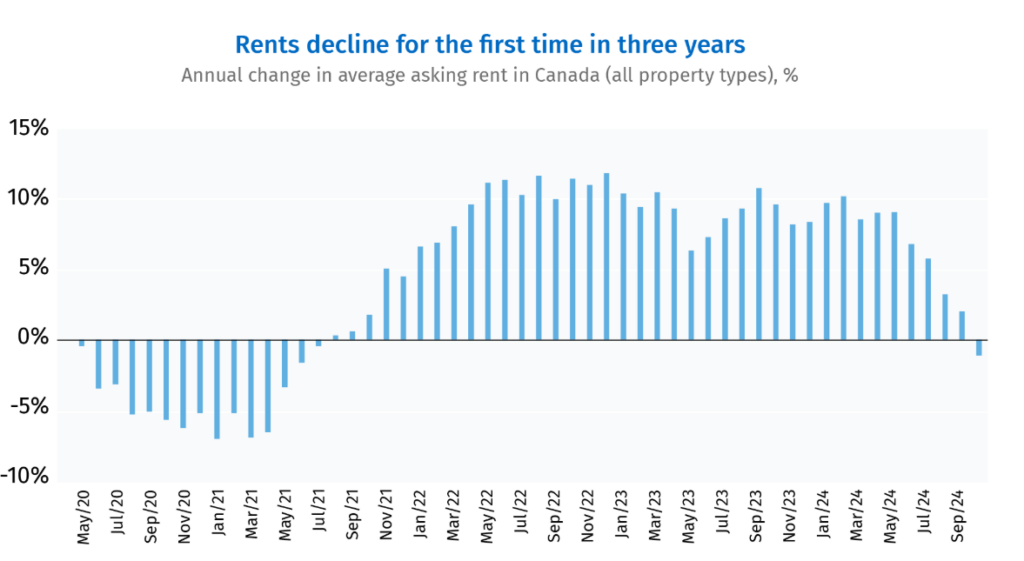

Falling rents in Canada are making headlines, as October saw a nationwide decline in asking prices for the first time in three years. This trend is particularly evident in cities like Toronto and Vancouver, where rent unaffordability has been a persistent issue. With these shifts in the rental market, many are asking: Is this a fleeting reprieve, or the start of a more sustainable trend?

Why Are Falling Rents in Canada Happening Now?

Increased Rental Supply Balances the Market

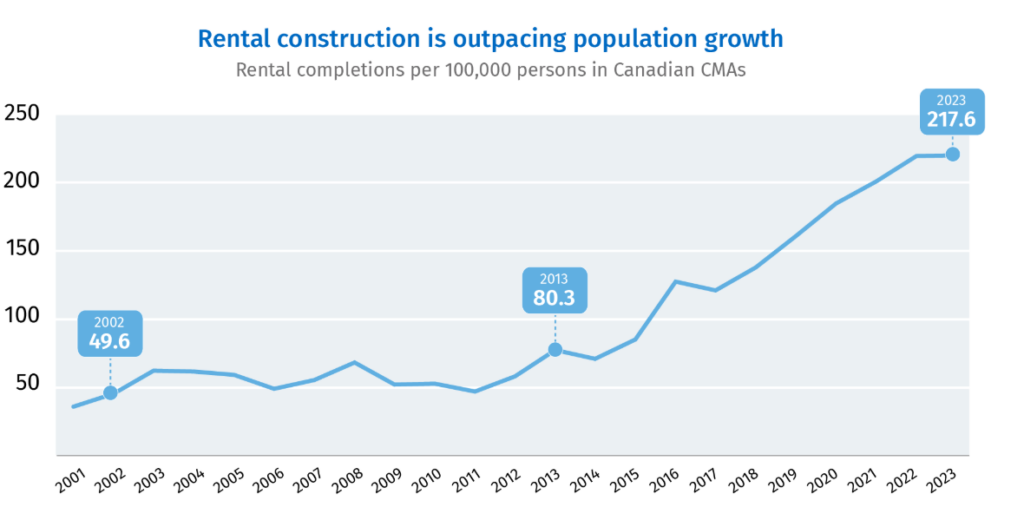

One major factor driving falling rents in Canada is the increase in completed rental projects. Over the past decade, purpose-built rental developments have surged, fueled by government incentives introduced in 2018. This has been particularly impactful in Toronto and Vancouver, where rental construction has outpaced population growth, offering more choices for renters and easing competition.

Immigration and Labour Market Shifts Reduce Demand

Canada’s new immigration policies are another significant contributor. Lower immigration targets have slowed population growth, especially among international students and workers, who traditionally drive rental demand. Meanwhile, a softening labour market has led to higher unemployment, particularly among young workers. These factors have reduced rental demand as people bundle households or move in with family.

Regional Insights into Falling Rents in Canada

- Toronto and Surrounding Areas: In Toronto, the average asking rent for a two-bedroom unit dropped $320 (-9.4%). Nearby cities like Brampton (-$256) and Mississauga (-$111) saw similar trends.

- Vancouver and Burnaby: Vancouver’s asking rents fell by $478 (-12%), while Burnaby experienced a $349 decline. Despite this, both cities remain among the most expensive markets in Canada.

- Smaller Markets on the Rise: In contrast, cities like Saskatoon, Winnipeg, and Regina have seen rents climb, though at a slower pace than earlier this year.

What Does This Mean for Renters and Investors?

Falling rents in Canada bring temporary relief for tenants but signal a shifting rental market. While lower prices ease financial strain, they also present new opportunities for investors to reevaluate strategies. The balance of supply and demand will likely stabilize rents in the long term.

If you’re navigating these changes, Jared Gibbons, an experienced real estate advisor, can provide expert guidance on renting, investing, or purchasing a property.