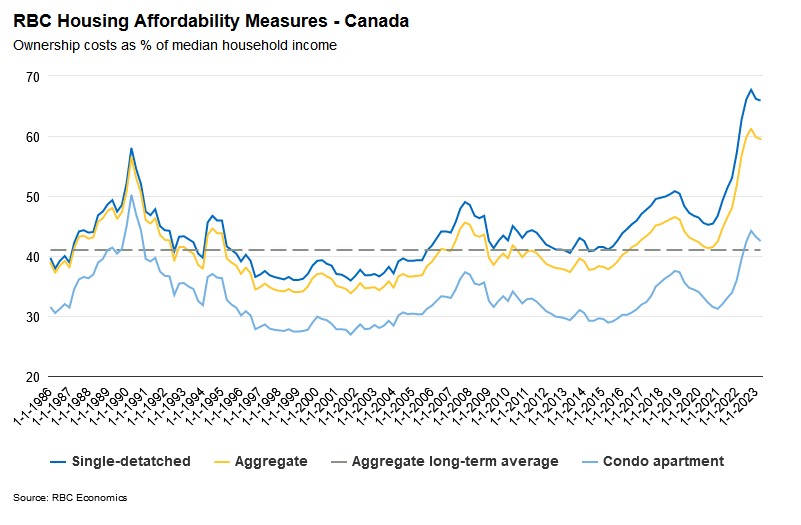

If you’ve been keeping an eye on the housing market in Canada, you’re probably aware that affordability has been a hot topic for quite some time. In the second quarter of this year, there was a small glimmer of hope as RBC’s affordability measure for Canada showed a slight improvement, dropping by 0.3 percentage points to 59.5%. While this is a step in the right direction, it’s essential to understand that the burden of owning a home in Canada remains quite heavy.

Let’s break it down in simpler terms:

-

Some Good News:

In the second quarter, household incomes in Canada saw a boost, which helped improve affordability a bit. This means that for some people, it became slightly easier to consider buying a home.

-

The Not-So-Good News:

Despite this small improvement, housing affordability in Canada, especially in cities like Vancouver, Toronto, and others, is still near its worst levels ever. So, while it’s a bit easier for some, it’s still very tough for many Canadians to buy a home.

-

Regional Variations:

The improvement in affordability was not consistent across the country. In some parts of Central and Atlantic Canada, things got a bit better, but in cities like Vancouver and Toronto, housing costs continued to rise, making it harder for people to own homes.

-

The Future Looks Tough:

Unfortunately, it’s unlikely that the situation will change quickly. High interest rates are expected to continue, which will keep the bar high for potential home buyers. We might have to wait until around mid-2024 before we see any significant improvement.

Now, let’s take a quick look at how different cities in Canada are faring:

Victoria: Despite a slight improvement in affordability, owning a home in Victoria is still incredibly tough, with an affordability measure at an astounding 73.0%. This high bar is holding back demand.

Vancouver: The market in Vancouver remains prohibitively expensive, with affordability levels not getting much better. The hope for improvement has taken a hit.

Calgary: Calgary stands out as the hottest market in Canada, with steady price increases and high demand. Affordability has decreased but doesn’t seem to deter buyers.

Edmonton: Edmonton maintains affordability within historical norms, with a relatively stable market.

Saskatoon: Saskatoon’s market is on the rise, with growing demand and modest price increases. Affordability remains reasonable for buyers.

Regina: Like Saskatoon, Regina is experiencing a market upswing, driven by population growth. Affordability is relatively good compared to other markets.

Winnipeg: Sales have picked up in Winnipeg due to population growth and slightly lighter ownership costs, making it more affordable compared to some other major cities.

Toronto: Toronto remains one of the toughest markets for home buyers, with an affordability measure of 79.6%. The dream of owning a home here is still out of reach for many.

Ottawa: Ottawa’s affordability has improved slightly, but it’s still quite challenging for many residents.

Montreal: Despite a recovery in the market, affordability conditions are still challenging in Montreal, with an affordability measure at 50.9%.

Quebec City: Quebec City offers manageable ownership costs, making it a reasonable option for average buyers.

Saint John: While affordability has decreased, Saint John still offers some of the better affordability conditions in Canada.

Halifax: Halifax’s affordability has lost some shine but remains in the middle of the pack among larger markets.

St. John’s: St. John’s is catching the eye of many buyers due to its affordability, although supply struggles to keep up with demand.

In summary, while there’s been a slight improvement in housing affordability in some parts of Canada, it’s still a significant challenge in many cities. The situation is expected to remain tough in the near term, and it may take several years and concerted efforts to bring about meaningful change in the housing market.

Please contact Jared Gibbons, your local realtor, should you have any questions!