Speculation Tax to Vancouver Island and Okanagan

In a significant development for South Surrey real estate, the province is expanding the Speculation tax to Vancouver Island and Okanagan.

Expanding to New Territories

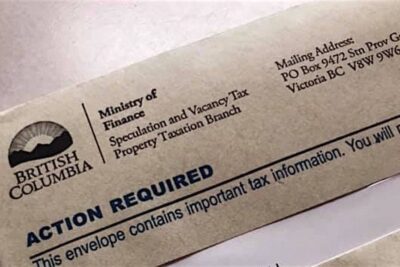

Starting in 2024, residents in 13 additional communities will face the Speculation and Vacancy Tax, originally introduced in 2018 to curb housing speculation and increase housing availability. The new areas include both Vancouver Island and Okanagan regions, with a particular focus on vacation destinations.

The affected Thompson-Okanagan communities are Kamloops, Salmon Arm, Vernon, Coldstream, Lake Country, Peachland, Summerland, and Penticton. On Vancouver Island, Courtenay, Comox, Cumberland, Parksville, and Qualicum Beach will also be subject to the tax.

Mixed Reactions

While the government’s decision aims to address the housing crisis, it has raised eyebrows among some experts. Brendon Ogmundson, chief economist with the BCREA questions these recreational rather than urban destinations. He believes that the policy shift reflects the dire housing supply situation in the province, but its actual impact on affordability remains uncertain.

As your trusted South Surrey Realtor, I understand that these changes may concern homeowners and potential buyers in our area. It’s essential to stay informed and seek professional advice to navigate the evolving real estate landscape.

Numbers and Exemptions

The government has not provided an estimate of how many homes could be added to the rental market. In Courtenay, it’s reported that only 3.1 percent of homes were vacant in 2022. Census data reveals higher vacancy rates in Peachland (8.4 percent), Penticton (5.9 percent), and Kamloops (4 percent).

The Speculation and Vacancy Tax has generated over $313 million, which has been reinvested into affordable housing.

Properties are exempt from the tax if they are occupied for at least six months of the year by their owners or long-term tenants. Certain life events, such as divorce or separation, may also qualify property owners for exemptions. Additionally, the tax does not apply to properties accessible solely by air or water, resort municipalities, or Indigenous lands.

Conclusion

The expansion of the Speculation and Vacancy Tax to Vancouver Island and Okanagan communities reflects the ongoing challenges in British Columbia’s housing market. While its effectiveness in addressing affordability remains a topic of debate, the government’s aim to increase housing availability and curb speculation is clear.

As your South Surrey Realtor, I’m here to provide guidance and support through these changes. Staying informed about the latest developments and seeking professional advice are essential steps for homeowners and investors in these affected areas.

If you have any questions or concerns about how these changes might impact South Surrey real estate, please don’t hesitate to reach out! Contact Jared Gibbons!